idaho sales tax rate in 2015

Web And Maryland charge similar sales tax rate of 6 slightly lower than Idaho and West Virginia that charge 601 and 603. The average local tax was about 001 percent meaning that the average combined sales tax was about 601 percent.

State And Local Sales Tax Rates In 2015 Tax Foundation

There is no applicable county tax city tax or special tax.

. There are a total of 112 local tax jurisdictions across the state collecting an average local tax of 0074. You can print a 95 sales tax table here. Plus 1125 of the amount over.

The state sales tax rate in Idaho is 6000. The 6 sales tax rate in Burley consists of 6 Idaho state sales tax. Web Download our Idaho sales tax database.

Web Determine the exemption allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. Some but not all choose to limit the local sales tax to. Web Idaho has a higher state sales tax than 692 of states.

The 6 sales tax rate in Boise consists of 6 Idaho state sales tax. Web Sales Tax Distribution by County for 92015 10-16-2015 SPTD BaseExcess S3 Sales Tax Distribution by County for 92015 10-16-2015 County Summary. The Stanley Idaho sales tax rate of 85 applies in the zip code 83278.

There is no applicable county tax city tax or special tax. Web Idaho ID Sales Tax Rates by City. Web 3 lower than the maximum sales tax in ID.

Average Sales Tax With Local. Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to. Web The 9 sales tax rate in Sun Valley consists of 6 Idaho state sales tax and 3 Sun Valley tax.

You can print a 9 sales tax. Exemption Allowance. With local taxes the total sales tax rate is between 6000 and 8500.

Web 280 rows Idaho Sales Tax. There is no applicable county tax city tax or special tax. Web Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax.

Remember that zip code boundaries dont always match up with. Web 3 lower than the maximum sales tax in ID. Web Idahos state sales tax was 6 percent in 2015.

Web 3 lower than the maximum sales tax in ID. The 6 sales tax rate in Star consists of 6 Idaho state sales tax. Web 3 lower than the maximum sales tax in ID.

Plus 3125 of the amount over. There is no applicable county tax or special tax. Plus 3625 of the amount.

The 6 sales tax rate in Caldwell consists of 6 Idaho state sales tax. The Idaho sales tax applies to the sale rental or lease of tangible personal property and the sale of some services. Web Tax Rate.

There is no applicable county tax city tax or special tax. Web Idahos state sales tax was 6 percent in 2015.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Idaho State Tax Tables Idaho State Withholding 2015

Idaho Gets D Grade In 2015 State Integrity Investigation Center For Public Integrity

State Corporate Income Tax Rates And Brackets Tax Foundation

Idaho Ranks 21st In The Annual State Business Tax Climate Index Stateimpact Idaho

100 Will Get You Almost 10 Further In Idaho Than In Washington Bloglander

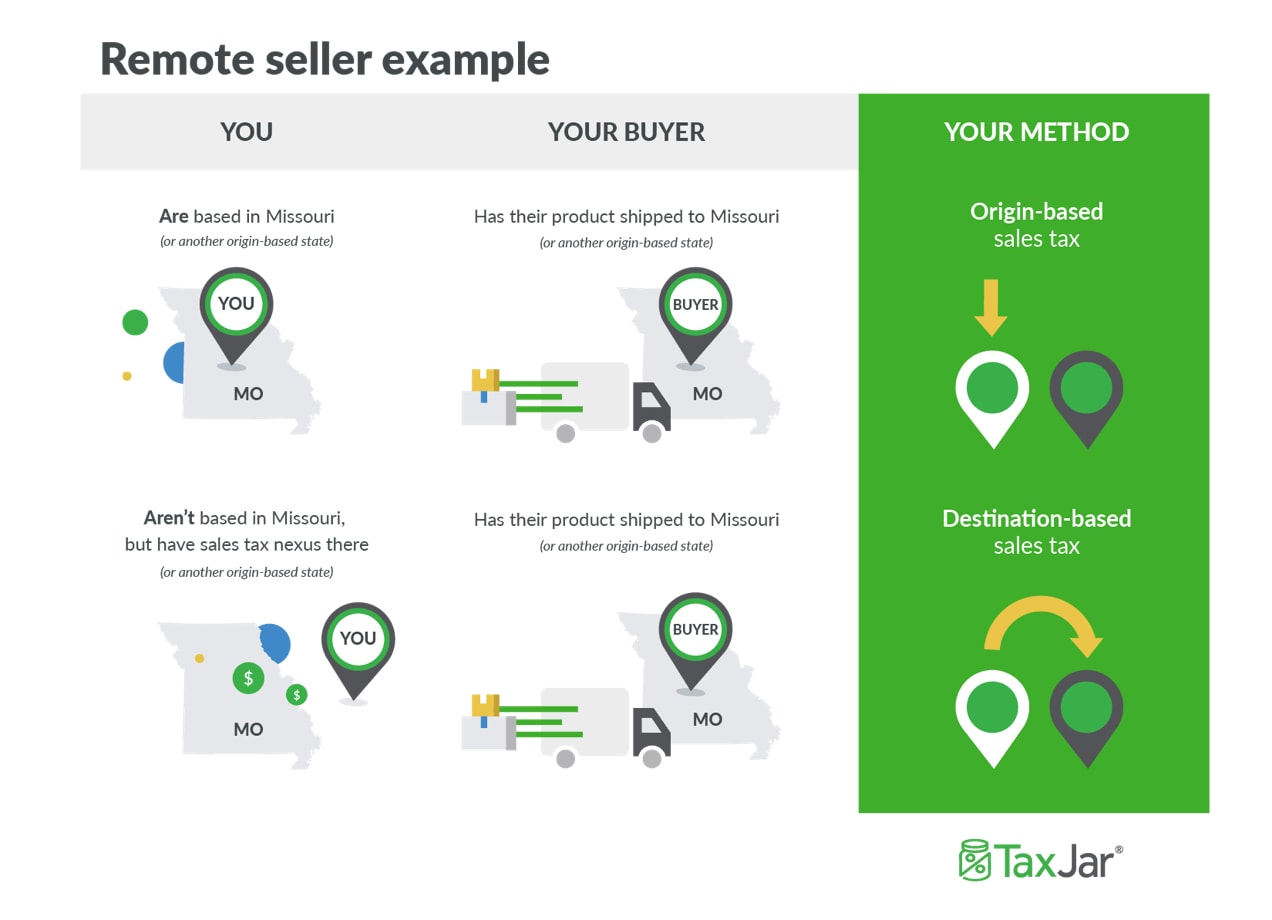

How To Charge Your Customers The Correct Sales Tax Rates

How Idaho S Taxes Compare To Other States In The Region Boise State Public Radio

Exploding Population Boom In Idaho Is Affecting Domestic Water Supply Idaho Capital Sun

State Tax Levels In The United States Wikipedia

Idaho Student Loan Forgiveness Programs

Sales Taxes In The United States Wikipedia

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Idaho Property Tax The Complete Guide To Rates Assessments And Exemptions

The 2006 Tax Shift Still Divides Idaho Leaders

Conformity And Child Tax Credits How Idaho S 100 Million Tax Cut Could Raise Taxes On Large Families Tax Policy Center